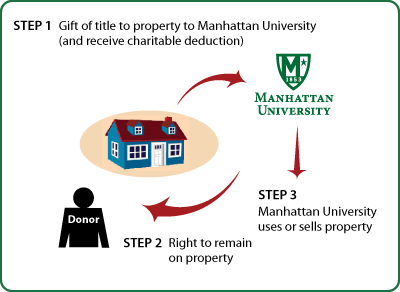

Gift of Personal Residence or Farm with Retained Life Estate

How It Works

- Transfer title to personal residence or farm to Manhattan University

- No change in your lifestyle—you (and spouse) occupy and enjoy residence or farm for life

- Manhattan University keeps or sells property after your death(s)

Benefits

- No out-of-pocket cost for substantial gift to Manhattan University

- Federal income-tax deduction for remainder value of your residence or farm

- You (and spouse) can occupy residence for life

Next Steps

© Pentera, Inc. Planned giving content. All rights reserved.